The System Isn't Broken. It's Built This Way.

When tax cuts for billionaires are celebrated and food assistance cuts are cheered, something deeper is broken.

The System of Suspicion

Yes, there's some disability fraud—just like there's some mail fraud. But imagine if politicians responded to mail fraud by treating everyone who uses the postal system like a criminal. Every envelope questioned. Every package delayed. Everyone presumed guilty unless they prove otherwise.

"The system is built on suspicion, not support."

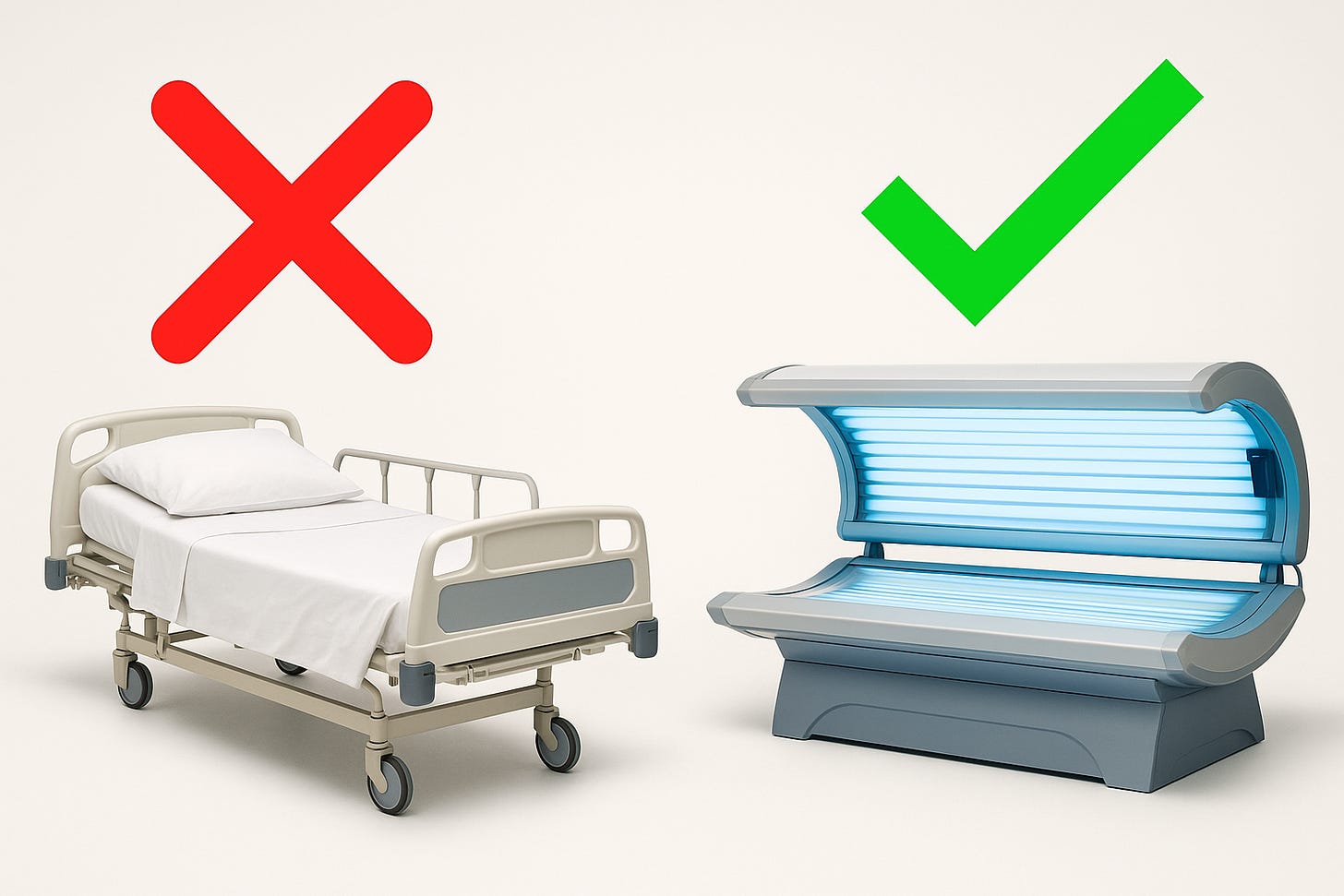

That's how disability is treated. The system is built on suspicion, not support. And the idea that it's "full of scammers" isn't just false—it's used to justify making the process so grueling, invasive, and dehumanizing that people give up before they ever get help. Worse, it's used as cover by politicians who want to cut services even further—slashing funding, tightening rules, banning certain purchases, or denying entire categories of need.

What It Actually Takes to Live Disabled

Meanwhile, disabled people are already managing a lot. Just getting through the day takes serious effort—handling medical needs, navigating Medicare, arranging transportation, securing housing, and getting by in a world that constantly works against them. Some can work a little, but earning too much puts everything at risk—healthcare, food, shelter. And all the while, they're expected to constantly re-prove they're "disabled enough." Just to keep what little help they get.

There's no workaround for needing medical care, housing, or food.

Now back to the mail analogy: people don't have time to jump through hoops just to use the postal service. They have jobs, families, school, and full lives. But at least with mail, they might find alternatives—email, couriers, or online systems. People with disabilities don't have that luxury.

And no, the private sector won't step in—not in a way that meets the need. What would be offered instead is the bare minimum, cut to the bone, with profits in mind. Help would go to the cheapest cases, not those struggling the most. That's not a solution. It's just a quieter way of saying: some people don't matter.

Who Gains. Who Pays.

Trump's new tax proposal builds on the 2017 tax law—which heavily favored the wealthy—and proposes going even further. Here's what that looks like in practice:

By 2027, if the Trump tax cuts are extended:

• The top 0.1% (those making $4+ million per year) would receive an average annual tax cut of $193,000.

• The top 1% would receive 23% of the total tax benefit.

• The bottom 60% of Americans would receive only 13% combined, and many of their cuts would expire.

(Source: Tax Policy Center)

Corporate tax rates were slashed from 35% to 21% in 2017. Trump and GOP allies have floated reducing them even further. These cuts largely benefit shareholders—and the top 10% of Americans hold nearly 90% of all stocks.

Capital gains and estate taxes—two of the biggest tools billionaires use to shield wealth—are also targets. Proposals include:

• Eliminating the estate tax (which only affects estates over $13.6 million)

• Reducing or indexing capital gains taxes, which already let investment income be taxed at a lower rate than wages.

So when people say this tax plan is about "growth" or "relief," understand this: the vast majority of the dollar value goes to the wealthiest Americans—especially billionaires.

Meanwhile, politicians pushing these cuts are also pushing new limits on Medicaid, food assistance, disability benefits, and housing programs. They're making it harder to survive—while making it easier to hoard.

This isn't about punishing success. It's about refusing to reward exploitation and neglect.

Suspicion for the Struggling. Silence for the Rich.

Have you noticed how those pushing the loudest for "accountability" when it comes to the disabled, people just trying to get by on low incomes, or the sick are often silent when it comes to billionaires?

They want suspicion for people who need help—but not for those who profit from the system.

They want suspicion for people who need help—but not for those who profit from the system. They want scrutiny for the struggling, but trust for the powerful.

That double standard didn't happen by accident. It's been engineered—and sold to the public as common sense.

See endnote: A sitting U.S. Senator once oversaw the largest Medicare fraud settlement in American history.

You Wouldn't Know It, But Billionaires Also Benefit From Government

They didn't build the roads to their factories. They didn't train their own workforces. They didn't protect their shipping lanes, develop the internet, or guarantee the contracts that make their businesses stable. The government did. Taxpayers did.

They benefit constantly. But they're rarely asked to contribute accordingly.

Billionaires benefit from public infrastructure, federally funded research, a functioning court system that enforces contracts and intellectual property, and financial stability guarded by federal institutions. Many benefit directly from subsidies, tax credits, favorable zoning, and trade protections. When the system works for them, it's just called "the economy." When it works for anyone else, it's called a handout.

They benefit constantly. But they're rarely asked to contribute accordingly. And when the bill comes due, it's people like me who get cut.

So What Now?

Many on the right don't support this out of cruelty. Some genuinely believe it's about freedom, efficiency, or responsibility. Others have been misled—taught to distrust anything involving government or convinced that fraud is everywhere. But the effect is the same. Whether through loyalty, ideology, or misinformation, these policies consistently hurt those who are struggling the most while benefiting those with the most.

So when you hear about Trump's "big, beautiful bill," remember who it's for—and who it's not. It's not for people like me. It's not for the elderly, the disabled, or the poor. It's for those already at the top—offering them more, while quietly justifying taking even more away from everyone else.

This isn't just policy. It's a moral test of whether we look out for those who are struggling—or reward the powerful at their expense.

Further Reading:

• Tax Policy Center – Distributional analysis of Trump tax cuts

• ProPublica – The Secret IRS Files

• Congressional Budget Office – Effects of extending the Trump tax cuts

• NYT: Trump Promises 'Big, Beautiful Tax Cuts' if Re-Elected

• WSJ: Republicans Eye Another Round of Supply-Side Tax Cuts

Endnote: Rick Scott and the Largest Medicare Fraud in U.S. History

Before entering politics, Florida Senator Rick Scott was the CEO of Columbia/HCA, a massive hospital chain. Under his leadership, the company was found to have systematically defrauded Medicare through illegal billing practices.

In 2003, the U.S. government reached a $1.7 billion settlement with the company—the largest Medicare fraud settlement in U.S. history. Scott resigned during the investigation and left with $300 million in stock and severance.

He later ran for office campaigning on tighter controls for programs like Medicaid, Social Security Disability Insurance, and food assistance—the very systems his company had defrauded.

Sources:

• CNN

• CBS News